50+ is mortgage insurance premium tax deductible 2021

Web The recently signed Consolidated Appropriations Act 2021 includes a one-year extension of the mortgage insurance premium deduction as qualified residence. SOLVED by TurboTax 5787 Updated 2 weeks ago.

5 Often Overlooked Income Tax Breaks

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

. A general rule of thumb is that homeowners pay 50 a month in PMI. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Taxes Can Be Complex.

Web Can I deduct private mortgage insurance PMI or MIP. Web The deduction for mortgage insurance premiums and other deductible interest will be reported together on Form N-15 line 38c. Prior tax years Mortgage Insurance Premiums you paid for a home where the loan was secured by your first or.

Web The federal tax deduction for private mortgage insurance PMI eliminated by Congress in 2017 is back. Whether you qualify depends on both your filing status and. The election to deduct qualified mortgage in-surance premiums you paid under a mortgage insurance contract issued after December 31.

Web Up front PMI paid has to be spread over a 84 month period or the life of the loan whichever is less. It is deductible on your federal income tax return as an itemized. Web 2021 Mortgage Insurance Premium Deductibility3 Traditionally homeowners who itemize their tax deductions have been able to deduct the interest.

If you are claiming itemized deductions you can claim the PMI. Tax Announcement 2021-01 - Mortgage. If they drop mortgage insurance and the lender paid a refund.

Web What is the mortgage interest deduction limit for 2021. However higher limitations 1 million 500000 if married. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web In December 2021 the Middle Class Mortgage Insurance Premium Act again sought to make the deduction permanent along with increasing the income. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web Not everyone can take advantage of the deduction for qualified mortgage insurance premiums MIP. Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI. Taxes Can Be Complex.

That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. Web The PMI Deduction will not been extended to tax year 2022.

Web Mortgage insurance premium. Web Borrowers are only permitted to deduct that portion of their mortgage insurance premium attributable to a tax year. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

The itemized deduction for mortgage insurance premiums has.

2022 Tax Changes Kings Path Partners

The Fintech Times Special Edition Asia S Digital Ecosystem By The Fintech Times Issuu

Understanding The 3 Year High Performance Of Manufacturing Index Pmi For February Segen Recruitment

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

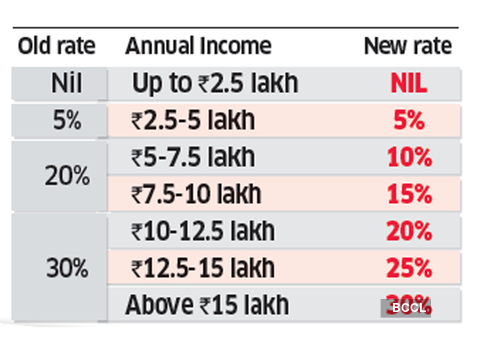

Income Rs 60 Lakh How The New Income Tax Regime Will Impact Taxpayers Under Different Incomes The Economic Times

Can I Deduct Private Mortgage Insurance Premiums Tax Guide 1040 Com File Your Taxes Online

Real Property Tax Howard County

Mortgage Insurance Paid Upfront The New York Times

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

Is Mortgage Insurance Deductible In 2021

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Can I Deduct Mortgage Insurance Premiums

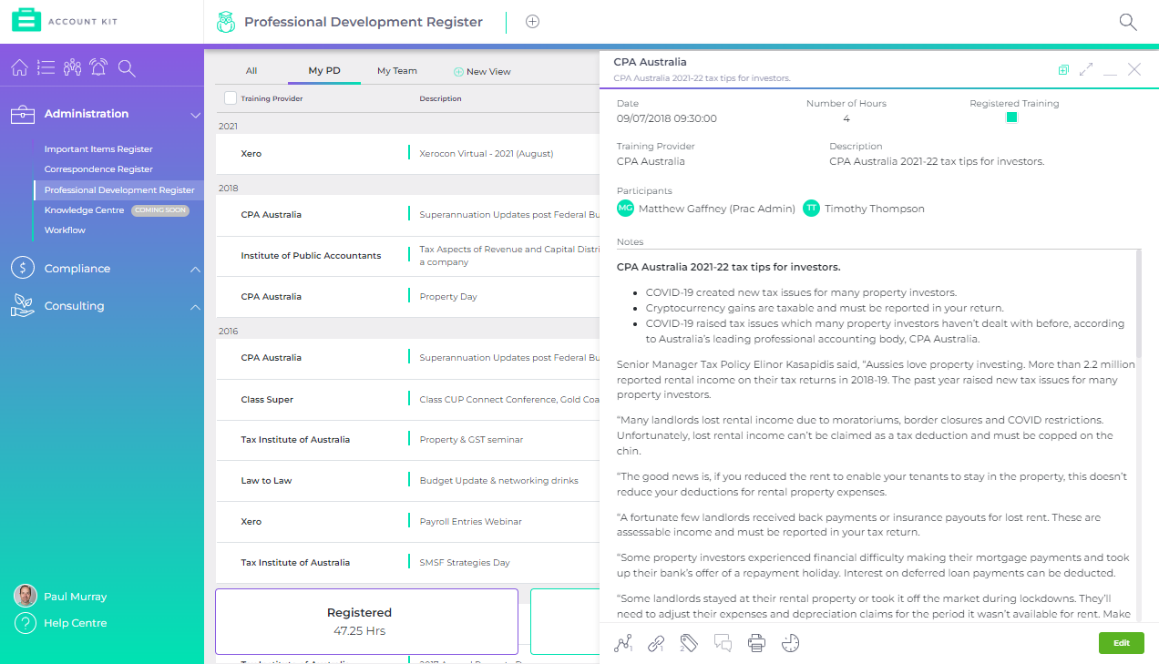

Tools Accountkit

What Are Premium Tax Credits Tax Policy Center

Tax Reduction Strategies For High Income Earners 2022

10 Types Of Insurance You Don T Need

Tax Deductions That Ruin Homebuying Credit Com